KEEPING A GOOD CREDIT SCORE

KEEPING A GOOD CREDIT SCORE

Here is my story of “how I managed to keep my credit score at a good rate.

Now I’m having the same car for over a decade. It is true that my existing car served me well through past years. But recently I have had thoughts about buying a new car to me. So I decided to begin shopping all over the place for a new vehicle. The major reason for me to buy a new car is this. I have been thinking about traveling around everywhere with some long road trips. Even though my current car has never failed me, I cannot take the risk of wandering alone the empty roads for hours to find someone to fix my car. Because my purpose of traveling is having some fun and some relaxation.

What facts should we consider when having a finance?

As we all now, purchasing a brand new car is way vaster than we think. It is a lots of money. But I don’t have any intensions to deal with that much money. So I thought of having a good dealer agreement to buy myself a car. But here we have a problem. If I want to finance it, I have to consider so many facts. I have to find a trustworthy bank to put my bucks. And also it should be profitable too. In other words it should be a low-interest finance. Almost about a 0% interest as same as I had for my current car.

Why should we keep a good credit score?

But, irrespective of what you are shopping, it’s no secret that the better your credit score, the higher mortgage fees you may qualify for. Inside the long time, these reasonably-priced prices can save you quite a few cash. Even a slightly higher hobby price on a car loan can grow to be costing you plenty more money in the end. When the time comes for me to shop for an automobile, I will be organized with a budget and a clear knowledge of the kinds of loans and quotes I’ll be eligible for.

How can we keep a good rate?

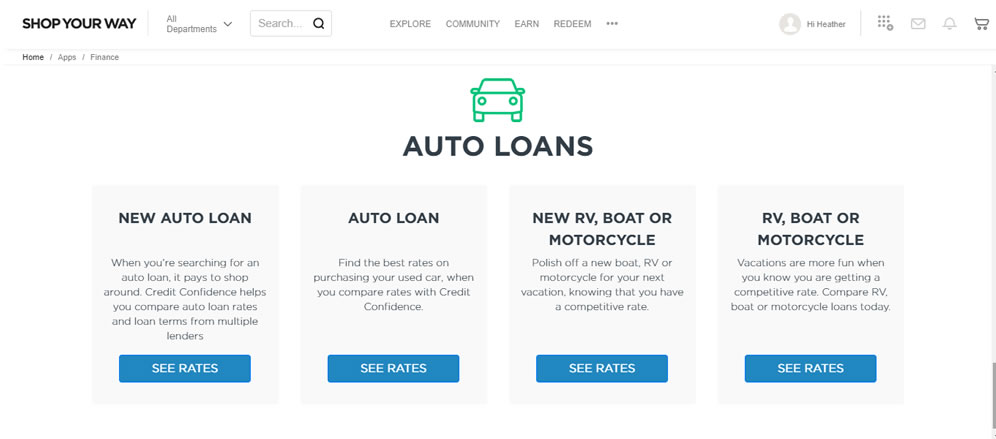

To make things high-quality is simple. I’ve been monitoring my credit score rating with credit confidence powered by way of “LendingTree” thru shopyourway.com. It is a free shopping rewards software. This software has thousands and thousands of contributors. It helps you to store your way and keep money while you stock your favored brands online. Not only that, you can devour at your favorite restaurants, travel, or even take an Uber. With every qualifying purchase, you get rewarded with cash-saving points. That can be redeemed for hundreds of thousands of blessings and gadgets throughout their network. Not most effective do you get rewarded for every buy you are making, however, you can additionally ensure you’re making the proper monetary choices with the assist in their partner, LendingTree.

How does it going on to have a good credit score via this software?

Sign on for a loose SYW credit self-belief account at shopyourway.com/creditconfidence and input a few records. Within minutes credit self-assurance will come up with your credit score rating. Within the dashboard, along with your credit score, you may also view adjustments to your credit history, your total credit, facts on all your present loans and credit cards, what elements are supporting or hurting your score. You furthermore may have to get admission to an internet market to buy loans like mortgages, automobile loans, credit score cards, commercial enterprise loans, deposit debts, scholar loans, and greater.

Credit score self-assurance usually analyzes your debts and will then ship you notifications approximately cash-saving possibilities together with tips for enhancing your credit. It makes preserving tune of your credit score simpler than ever.

Credit score self-assurance powered via lendingtree®:

- Get your actual-time credit score

- Research guidelines for improving your credit score rating

- Get right of entry to unfastened video guides that will help you benefit credit knowledge.

- Monitor your financial fitness to maintain you confident

- Locate loans that may prevent money

- Send you real-time credit score tracking signals

Credit score confidence makes use of a vantage score 3.0 credit score version, which is a credit score used by main credit bureaus. And there’s no want to fear because the service is absolutely secure the use of relaxed sockets layer (SSL) era and minimum 128-bit encryption. All of your information and statistics covered by other phrases.

Tips for taking a vehicle loan.

in case you’re shopping for an automobile loan some vehicle creditors or creditors will carry out what’s known as a difficult pull for your credit whilst you observe for prices. On account that numerous “difficult pulls” or credit score tests, can negatively have an effect on your credit score. Try to have all your difficult pulls done in short time frame to reduce the impact it’ll have on your credit rates. You don’t have to worry about the inquiries. All of the inquiries that has done within 14 days consider as only one.

Cool facts about this software.

One of the coolest elements about credit self-assurance is their video library of mini-courses that will educate you within the bits and bobs of super credit rates. Organized by way of different economic topics, you could select what you want to find out about and bypass the stuff you realize. there were no any doubts. The pointers are remarkable and the whole thing is explained without a doubt. A brilliant resource for enhancing your credit score fitness they’ll make your rate in levels of expert in no time.

Even if you’re now not planning on making a massive purchase in the close to destiny, keeping track of your credit is a notable economic wellbeing addiction to have. You by no means realize while you simply might need it! And a better score rating for you way extra financial flexibility. Which means getting you what you want when you need it even as saving plenty of cash in the end.

I really hope this has been a great help for you.

“Do you think this is helpful? If so, please share this article on Facebook, LinkedIn, etc. And we warmly welcome your queries, comments, and suggestions. Feel free to contact us. You can join our community and open help Topic under FINANCIAL HELP. It’s totally free! And, please don’t forget to like our Facebook page. Thank you very much! Have a nice day!”

Read More:

- Venmo Won’t Let Me Add Bank Account

- How to unlink bank account from Dave app

- How to add money to Robinhood without bank account

Lucas Noah, with a Bachelor of Information Technology (BIT) degree, is a prolific writer known for his expertise in the tech world. Currently, he brings his wealth of knowledge to Creative Outrank LLC and Oceana Express LLC, enriching their websites with hi... Read more