Best Cheap Car Insurance for Bad Credit

Best Cheap Car Insurance for Bad Credit

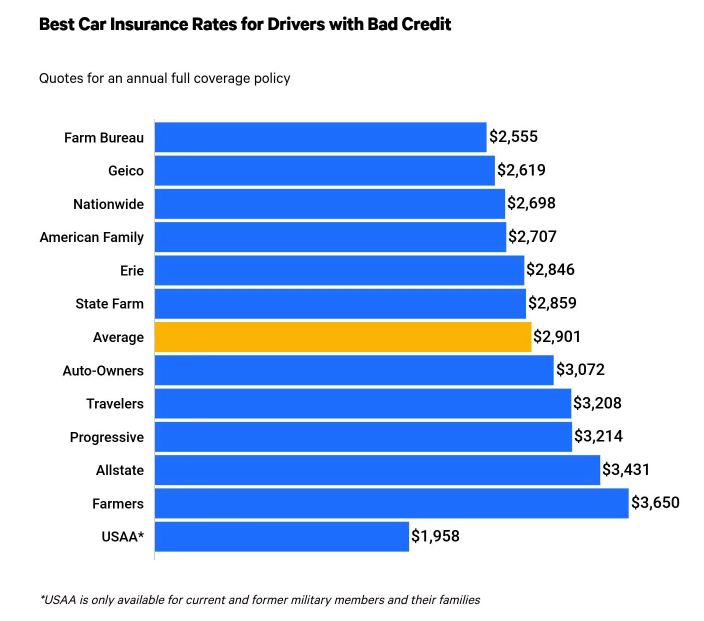

The farm bureau is enlisted among the best insurers. They provide the lowest car insurance for bad credit drivers and also for all sorts of drivers. USAA, the other company offers their lowest rates for the drivers of bad credits. But, the coverage is applicable only for military personnel, veterans, and their family ones. 60% of the lowest credit rate is demanded annually among the states that accept the rating of credit to apply for car insurance. Obviously, Geico raises the rate by 37% whereas Nationwide raises the rate up to 27%. The lenders ask for high rates from the poor credit-scored drivers due to the incapability of fulfilling the claims. For sure, you better read more quotes from various insurers irrespective of your credit score.’Best Cheap Car Insurance for Bad Credit’ will help you to avoid the issues. Let us go!

Cheapest car insurance for bad credit: Farm Bureau

No worries when you have the bad credits. The farm bureau provides low-priced car insurance. The average yearly premium of $2,555 and the full coverage is $64. This is inexpensive when compared with Geico.

Farm Bureau; Best Cheap Car Insurance for Bad Credit

Mostly, the federation of state organizations: Farm bureau provides the service for both farmers and non-farmers. The driver who has a low credit score is given $213 monthly as the full coverage insurance policy. The holder has to make the payments for the membership fee yearly. It costs less than $100. The coverage cannot be used within every state. Some of the Farm bureaus make the connection with another company to offer the very facility.

Geico; Best Cheap Car Insurance for Bad Credit

Among the widest network of lenders, Geico is on the top list. They provide the best rates for poor credit scores. Other than the USAA companies, the Geico offers the best rates in 16 states. It is ranked as the second or third among 15 states. The low credit-scored drives are paid an average of $218 monthly. Geico raises 37&, the rate limit for the poor credit drivers when compared with the other insurers with an average credit limit.

USAA; Best Cheap Car Insurance for Bad Credit

The best company that offers inexpensive options is the USAA for the bad credit scored ones. The company works in every state including D.C and Washington. It costs $163 as the monthly full coverage for the car insurance of the annual policy. That is the lowest rate up to now. USAA limits its quotes and policies to a particular group such as military members who work in the field, veterans including their family ones. This is the fifth larger company in the country. They have a wide proportion in the field rather than Farmers or the Allstate.

Best auto insurance for average credit: State Farm

Including the average credit, the top rate is provided by the State farm that has an annual premium of $69 yearly. It is inexpensive when compared with other options that save for USAA. The second place for the top rate is taken the famous, Erie. It costs $1,379 every year. Moreover, the companies of Auto-Owners, Geico, Farm Bureau, and American Family provide better rates than the average limit for the customers.

| Rank | Company | Rate per year |

| 1 | State Farm | $1,310 |

| 2 | Erie | $1,379 |

| 3 | Farm Bureau | $1,576 |

| 4 | Auto-Owners | $1,579 |

| 5 | American Family | $1,755 |

| 6 | Geico | $1,917 |

| 7 | Progressive | $2,036 |

| 8 | Nationwide | $2,127 |

| 9 | Travelers | $2,148 |

| 10 | Allstate | $2,349 |

| 11 | Farmers | $2,521 |

| N/A* | USAA | $1,170 |

*USAA can be applicable only for the current and former military persons including their family ones.

Cheapest car insurance for very good credit

The drivers who have good credits are welcomed by the State farm. They have to pay $847 yearly for the full coverage. The rate is lower than USAA that asks $1,011 for the payments. When the customers have a good credit limit the rate will be 33% in state farms. The other companies of progressive, Travelers, Erie, and Geico are also included in the list as follows.

| Rank | Company | Rate per year |

| 1 | State Farm | $874 |

| 2 | Erie | $1,051 |

| 3 | Auto-Owners | $1,029 |

| 4 | Farm Bureau | $1,397 |

| 5 | Geico | $1,531 |

| 6 | American Family | $1,481 |

| 7 | Travelers | $1,511 |

| 8 | Progressive | $1,511 |

| 9 | Nationwide | $1,772 |

| 10 | Farmers | $2,182 |

| 11 | Allstate | $2,016 |

| N/A* | USAA | $2,016 |

*USAA can be applicable only for the current and former military persons including their family ones.

The lenders of 18% will factor the credit into rates as the average limit. When the lenders reduce the rate, it will be about 6% as the least percentage. That will the least of their price by 10%.

No-credit-check insurance companies

The countries of Massachusetts, New Jersey, California, Hawaii, and Washington do not accept the companies to apply the credit score when the insurance rates are calculated. A few companies agree to offer insurance without checking the credit score. So, most of the particular local companies are unknown to the customers.

As the instances, Dillo in Texas, Cure Auto Insurance in New Jersey, and Pennsylvania are some of them. Under the survey that was conducted by conning, it reveals that 92% of companies consider the credit history.

Here, we make you aware of a tip that they play. When you are asked to provide the Social security number before they send the quotes, that is just to check your credit. At times, they may not try to check the credit but before the final rate, they look for your credit. Simply, at any point, they wish to check your credit.

Why is insurance more expensive for drivers with bad credit?

Under the explanation of the Federal Trade Commission report, it is evident that the companies tend to charge a high rate from the bad credit owners. That is because of the correlation between both lower credit and increasing value for filing a claim. When the drivers make a claim, the company has to pay for it. The very situation comes whenever either the driver has done the fault or the situation is covered by the collision insurance. Sometimes, the companies tend to expect more rates from the customers who make higher policy payments. Finally, the customers who have bad credits are expected to pay higher rates rather than the good credit customers.

The customers who do have not a credit history are also dropped into a similar level of bad credit customers. So, both two types of customers have to go for a higher rate.

In fact, the credit score of the driver does not shows that he is a dangerous driver on roads. But, they are expensive to insure the vehicle.

How to lower your rates if you have bad credit

We advise you to improve your credit score when you have a bad credit score. It is the best and perfect way to reduce the insurance rate. Depending on the credit score the company gets an idea of the way you can make the payments. It is true that none can quickly increase the credit score but try to do it little by little. After you increase your credit score you may have a lot of benefits.

Here are some tips to improve your credit score.

Pay the bills without a delay:

Initially, try to make the payments on time. It will beneficial for your future attempts. That is because the payment history is the rolling factor in the credit history. Finally, 35% will consider the FICO score.

Use a part of the credit that displays:

credit utilization ratio means the ratio of the credit that you utilize compared with the credit that you have to use for. When the ratio is below 30% is better for you to obtain the credit ratio. Because the credit usage reports for 30% of the credit score. Let us have an instance: If your credit card has $1,000 now, you have to manage the balance below $300. Even though the bills are paid regular method, your credit score will not raise. But, when you delay a payment it will harmful to the credit score and the rate. In detail, try to improve the credit score. Here are more typical methods to lower the rate in your insurance.

check the discounts;

Generally, The discounts types will be like good student discounts and good driver discounts. There are more insurance discounts will be available for you.

reduce the coverage;

If you try for the least liability, either the collision or the comprehensive insurance.

check for the most applicable one;

In fact, find out the number of options that help you to obtain the maximum benefits.

Frequently asked questions

- Is it possible to get a car having bad credit?

For sure, you can get a car. But, expensive charges may apply. According to the studies, low credit rates will increase up to 60% as the average limit.

- Does the bad credit increase car insurance and why does it happen so?

As the Federal Trade Commission report urges, the drivers who have bad credits have to file more claims other than the drivers who have a good credit score. In other words, the insurance for their vehicles will expensive than for others. In addition, they have to make a high rate for the insurance.

- Is there any possibility to get insurance without checking the credit?

You can do so. But, it is valid only for a few situations. Some of the insurance companies provide the insurance without checking the credit limits. Those who are considered as the risky drivers have high rates normally.

- What are the methods to decrease the rates when I have bad credits?

Specially, you better make the payments on time. For sure, it will help you to increase the credit limit. Furthermore, you can check for discounts, shopping, and manage the coverage to decrease the cost of the insurance.

Methodology; Best Cheap Car Insurance for Bad Credit

Obviously, there are the best and largest insurance policies among 45 states and the data was collected from every one of them. Let us have an instance for a clear idea. The driver is 30 years old. He has a 2015 Honda Civic EX. Hence, The full coverage policy is applied.

Here, the each of companies does not spread their meanings for bad, average, and very good credits. A sort of market will be a reason for the predictable cutoff mark. Quadrant Information Services is the resource that is used for this kind of analysis. Be mindful to use the quotes only for similar purposes whenever your rates get vary.

Read more:

- Which Type of Credit is Used to Lease a Building?

- 15 Ways to Rent Houses With No Credit Check

- How to Get Free DoorDash Credits